In terms of guarding you as well as your assets, an insurance plan Answer is among the smartest investments you can make. But with numerous possibilities readily available, picking out the appropriate coverage can experience like navigating a maze. The good news is, being familiar with the strategy of an insurance policy Option may make the procedure much simpler. In the following paragraphs, we'll dive deep into what an coverage solution is, why It is critical, and How to define the perfect fit for your requirements. No matter whether you are a to start with-time customer or aiming to review your current protection, this guidebook will allow you to make informed selections.

An insurance policy Remedy refers to a customized program that satisfies your distinctive desires for financial defense. It is not almost picking a policy off the shelf—it’s about finding the ideal coverage that provides you with comfort while in the occasion of the unforeseen incident. Everyday living is unpredictable, and an insurance Answer makes certain that you happen to be ready for the worst, whether or not it’s a collision, a wellness unexpected emergency, or simply a pure disaster. Consider it as a security Web that catches you when life throws you off balance.

Considered one of The main components of an insurance plan Option is customization. In any case, no two individuals or companies are exactly the same. Your Way of life, profession, wellbeing, and financial situation all affect what type of insurance protection you will need. One example is, a younger Qualified just setting up their profession might require another insurance policies Answer than a dad or mum with little ones. In the same way, a small business enterprise operator might need unique protection that differs from that of the homeowner. The target is to develop a strategy that fits your special predicament.

Another important thing to consider in deciding upon an insurance plan Resolution is understanding the categories of insurance plan obtainable. You will find many alternative styles of coverage, from automobile insurance policy and residential insurance policies to existence, overall health, and business enterprise coverage. Every single serves a selected objective and can provide varying amounts of safety. An extensive insurance Option may possibly involve a mix of policies, each addressing various threats and wishes. This strategy can make sure you happen to be effectively-included without overpaying for avoidable extras.

Tailored Insurance Solutions Things To Know Before You Get This

When it comes to an insurance Option, it’s also vital to consider the monetary balance with the insurance plan provider. All things considered, if some thing happens, you would like to ensure that your insurance provider can spend out your promises. Studying a corporation’s standing, customer service file, and monetary energy scores will let you make a far more knowledgeable conclusion. A stable insurance plan supplier offers not just the coverage you need but in addition the reliability that you're going to be cared for when the time arrives.

When it comes to an insurance Option, it’s also vital to consider the monetary balance with the insurance plan provider. All things considered, if some thing happens, you would like to ensure that your insurance provider can spend out your promises. Studying a corporation’s standing, customer service file, and monetary energy scores will let you make a far more knowledgeable conclusion. A stable insurance plan supplier offers not just the coverage you need but in addition the reliability that you're going to be cared for when the time arrives.Insurance solutions are not just for individuals—they’re also important for businesses. A company insurance Alternative offers protection for the specific pitfalls that come with running a business. Whether you might be handling property harm, worker wellbeing Positive aspects, or legal responsibility promises, a business insurance policy Answer can secure you from financial losses that could if not cripple your functions. Smaller companies, in particular, can reap the benefits of custom made insurance deals that deal with their special difficulties, ensuring they could thrive devoid of stressing about unexpected dangers.

One of many most significant advantages of an insurance Alternative is definitely the reassurance it provides. In a earth packed with uncertainty, being aware of that you just’re included in case of an emergency might help ease stress. This feeling of safety enables you to focus on what definitely matters in everyday life—no matter if It can be taking pleasure in time with your family, increasing your vocation, or growing your company. An insurance plan Alternative is usually a game-changer, giving the liberty to Are living without having continually worrying concerning the "what-ifs."

Picking out an insurance policy Remedy isn’t normally an easy procedure. There are many alternatives and aspects to look at that it might experience overpowering. Even so, breaking down the decision-building system into scaled-down steps might make it simpler. Begin by evaluating your preferences—what dangers do you think you're most Explore here worried about? From there, research the different sorts of protection available, Review estimates, and overview buyer feed-back. By having a scientific strategy, you can make a choice that aligns with each your budget along with your protection demands.

It's also imperative that you Take note that an insurance Option can evolve after a while. As your situation change—no matter if you can get married, get a home, or begin a family members—you might require to adjust your coverage. The most effective insurance answers are Find out more flexible, letting you to update your policies as desired. This adaptability makes sure that your protection continues to meet your needs, despite exactly where daily life usually takes you.

One particular frequent blunder individuals make when picking an insurance policy Remedy is underestimating the value of sufficient coverage. It might be tempting to choose the cheapest plan offered, but This could certainly depart you susceptible within the event of the claim. Try to remember, you can get what you buy. A reduced-Price insurance coverage Answer may possibly help save you funds upfront, but if it doesn’t offer you plenty of coverage, it could finish up costing you far more Ultimately. It really is often improved to buy the ideal quantity of defense than to possibility economic catastrophe.

An generally-disregarded aspect of insurance policies remedies would be the part of deductibles and rates. When evaluating policies, It is really necessary to understand how these aspects function collectively. The deductible is the amount you pay out away from pocket before your insurance company handles the remainder of the assert. A better deductible generally suggests reduced rates, but In addition it indicates you’ll pay additional upfront in case of an emergency. Discovering the ideal harmony in between deductible and quality is essential to developing a sustainable and helpful insurance policy Answer.

One factor that will affect your preference of the insurance coverage Answer is the level of client aid the insurance provider features. Insurance policies policies is usually sophisticated, and possessing a dependable support program in position can make a huge distinction. No matter if it’s answering your concerns, serving to you file a assert, or assisting with policy adjustments, wonderful customer support is essential. Search for an insurance company that offers 24/seven guidance, on-line assets, and easy access to agents. Excellent conversation is an essential Element of the overall knowledge.

While it may seem to be an insurance Remedy is about chance administration, there’s also a economical reward to having the correct protection in place. A effectively-structured insurance plan solution will help guard your belongings, which subsequently assists protect your prosperity. Whether it’s shielding your property from problems, your car from accidents, or your enterprise from liability promises, coverage acts being a safeguard for your personal fiscal upcoming. It really is like acquiring an umbrella inside of a storm—you might not have to have it each day, but any time you do, it could help you save from significant losses.

Unknown Facts About Home Insurance Protection Solutions

Not known Incorrect Statements About Insurance Deductible Solutions

An often forgotten but precious element of an insurance Alternative is The provision of bargains. Many insurance plan providers offer reductions for such things as bundling procedures, possessing a thoroughly clean driving report, or setting up security attributes in your house or automobile. Benefiting from these reductions can reduce your premiums without having compromising your coverage. It’s always really worth asking your insurance company about prospective discount rates and looking at how It can save you.

For individuals who are new to insurance plan, obtaining the right Answer may well come to feel like a frightening task. But it surely doesn’t must be. Commence by speaking to an coverage advisor who will let you navigate the choices. These industry experts can help you Insurance for Renters assess your needs, recognize your choices, and provide customized suggestions. With their skills, you may make a well-knowledgeable conclusion about which coverage Option best suits your lifestyle and spending budget.

One of the More moderen developments during the insurance policy field will be the increase of electronic insurance plan alternatives. With the arrival of technology, shopping for and managing coverage has grown to be more practical than in the past. Several insurers now present on line platforms the place you will get quotations, Review procedures, and even file promises with no leaving your home. These electronic resources are which makes it less difficult for folks to discover and manage their insurance methods with just some clicks.

Lastly, Permit’s discuss the part of believe in in picking an insurance Option. Believe in is important With regards to insurance coverage—All things considered, you’re counting on your service provider to have your back again when items go wrong. That’s why it’s essential to go with a dependable insurance company with a good background of dealing with promises. Examining client assessments and checking marketplace scores may help you gauge the trustworthiness of a corporation. Have faith in your instincts and take some time to research right before committing to any coverage.

In conclusion, an insurance policies Resolution is a lot more than simply a policy; it’s a strategic Device that provides monetary defense, reassurance, and protection in an unpredictable earth. By being familiar with your preferences, evaluating selections, and working with a dependable supplier, you will discover the right insurance coverage Alternative to safeguard your long term. Whether you’re insuring your wellbeing, your house, or your small business, the best coverage may make all the main difference when daily life throws you a curveball.

Spencer Elden Then & Now!

Spencer Elden Then & Now! Taran Noah Smith Then & Now!

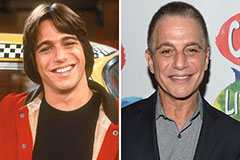

Taran Noah Smith Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!